What is e-Refund?

e-Refund (direct deposit) is a method of payment which electronically credits your checking or savings account for financial aid or other credit balances in your student account. Instead of receiving a paper check, electronic deposits are quickly processed through the National Automated Clearing House.

We strongly encourage you to set up a direct deposit bank account. It's the fastest, most secure, and environmentally friendly way to receive your refund. Please note that students with a Federal Parent Plus loan may not be eligible for direct deposit if the refund is from the Parent Loan. If this is the case, the refund will be made via check to the parent.

Is my bank information secure using e-Refund?

e-Refund eliminates the possibilities of lost or stolen checks in the mail or when carrying them to the bank for deposit. Enter your bank information once on our secure Banner Self Service Site and have your refund deposited directly into your bank account.

How long will it take for me to receive my refund?

e-Refund deposits will be sent to the Automated Clearing House on each Wednesday and are generally available in your bank account within 1 - 2 banking days after the file has been sent. An email will be sent to let you know that the e-refund is on its way to your bank. However, e-Refunds are deposited into your bank account in accordance with your bank’s policies and procedures. Campus holidays, banking holidays and inclement weather may delay a deposit.

If you are not using e-Refund, refund checks are processed weekly. You will be notified via OW email when the check is mailed to your home address. Please ensure that your home address is updated to prevent delays in receiving your refund.

How do I set up direct deposit?

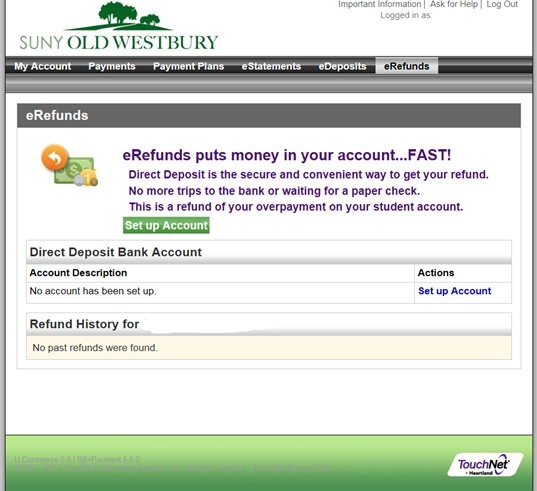

To set up the direct deposit log in to the ConnectOW portal and visit the Manage My Account Card. From the quick links, click beginning with "E-Bill", and then "Refunds." You must specify a U.S. personal checking or savings account as your direct bank deposit account. Please be very careful when entering your bank information as incorrect data may cause a delay in your refund.

If using your personal checking account:

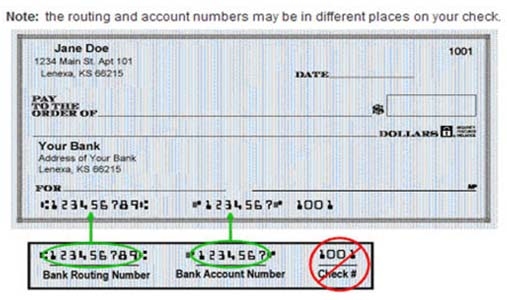

Before enrolling in direct deposit, you must have a paper check to obtain the routing and checking account number (see illustration below). If you don't have a check or the routing and checking account number, contact your banking institution for this information.

If using your personal savings account:

Use the routing and savings account number indicated by your banking institution (this may be found on your deposit slip in a similar location to the check illustration below). If you don't have the routing and savings account number, please contact your banking institution for this information.

I received an email there is a problem with my account

If you receive an email from Bursar stating that there was a problem with your e-Refund, it is because we received a message from your bank that there is an error in the banking information that you provided or the account was closed. Please correct the account information through the e-Bill site immediately. Once you have done so you must email Bursar@oldwestbury.edu. If the information is not corrected, your e-refund information may be deleted to avoid using the incorrect information. Please note you may receive a paper check during this time and your refund may be delayed as the Bursar’s Office must wait for the disbursed funds to be returned to us before we can reissue your refund.

Note: SUNY Old Westbury will not use your direct deposit information to auto-debit from your account.

Troubleshooting

Your direct deposit account may be returned as invalid if:

- You do not enter you bank information correctly

- You use your debit card number as the account number

- You use an "electronic" routing number

- You designate a money market account (must be a checkbook savings or checking account)

- Your bank account is closed