Eligible educational institutions, such as SUNY Old Westbury, are required to submit the student's name, address, taxpayer's identification number, enrollment and academic status to the IRS. The IRS instructs institutions to report payments received (Box 1) for qualified tuition and related expenses. SUNY Old Westbury reports amounts paid to qualified tuition and related expenses during the tax year (Box 1) and scholarships and grants (Box 5).

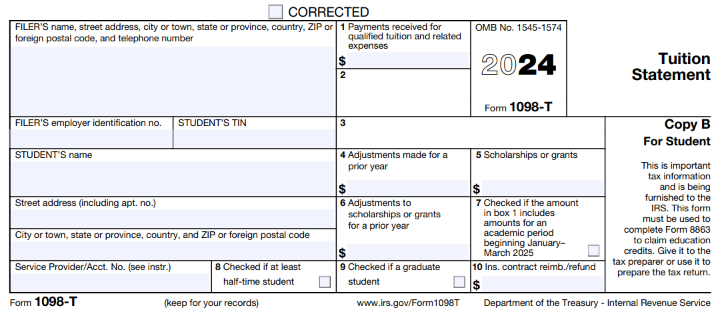

Provided on this page is a blank sample of the 2024 Form 1098-T, that you will receive in January 2025, for your general reference. Visit the IRS website for more information about Form 1098-T.

Depending on your income (or your family’s income, if you are a dependent), whether you were considered full or half-time enrolled, and the amount of your qualified educational expenses for the year, you may be eligible for a federal education tax credit or deduction. (You can find detailed information about claiming education tax credits or deductions on the IRS website for the 1098-T.

The dollar amounts reported on your Form 1098-T may assist you in completing IRS Form 8863 – the form used for calculating the education tax credits that a taxpayer may claim as part of their tax return.

SUNY Old Westbury is unable to provide you with individual tax advice, but should you have questions, you should seek the counsel of an informed tax preparer or advisor.

IRS 1098-T Form for 2024 "Instructions for Student"

- Filer’s federal identification number. This number represents State University of New York at Old Westbury Federal ID number (EIN).

- Student's identification number. For your protection, this form may show only the last four digits of your social security number (SSN), individual taxpayer identification number (ITIN), or adoption taxpayer identification number (ATIN). However, SUNY Old Westbury has reported your complete identification number to the IRS and, where applicable, to state and local governments.

- Account number. May show an account or other unique number that SUNY Old Westbury assigned to distinguish your account.

- Box 1. Only payments for qualified tuition and related charges will be eligible to be reported. Room and meals are not considered qualified education expenses by the IRS, so payments made towards these charges will not be reflected on Form 1098-T.

- Box 2. This box is no longer being used and should be blank.

- Box 3. This box is no longer being used and should be blank.

- Box 4. Shows any adjustment made for a prior year that resulted in a reduction of payments toward previously reported qualified tuition and related expenses.

- Box 5. Reflects the amount of all scholarships and grants disbursed in a calendar year towards cost of attendance. Scholarships and grants are defined by the IRS, so may include items that you do not recognize as a scholarship or grant-- for example, waivers are not reported in Box 5, however military benefits and payments from third party organizations may be. Amount reported on Box 5 may exceed amount reported on Box 1.

- Box 6. Shows adjustments to scholarships or grants for a prior year. This amount may affect the amount of any allowable tuition and fees deduction or education credit that you claimed for the prior year. You may have to file an amended income tax return (Form 1040X) for the prior year. Your tax preparer should be consulted.

- Box 7. Reflects whether the amount in Box 1 includes payments for academic period beginning January – March 2025. See Pub. 970 for how to report these amounts.

- Box 8. Is checked if a student attended SUNY Old Westbury at least half-time during any academic period that began in 2024.

- Box 9. Shows whether you are considered to be enrolled in a program leading to a graduate degree, graduate-level certificate, or other recognized graduate-level educational credential.

- Box 10. Should be blank.

General Questions & Answers

- What is Form 1098-T?

Colleges and universities are required by U.S. law each year to provide each student who is a "US citizen" with Form 1098-T, to assist the students and their families in computing any tax credit or deduction they may be able to claim, based on amounts they have spent for education. For 2024, these federal tax benefits include the American Opportunity Credit, the Lifetime Learning Credit, and the tuition and fees deduction. - Will I receive Form 1098-T?

OW students whose account had payment transactions posted to it during the calendar year will receive a Form 1098-T in late January. You may receive Form 1098-T even if you did not attend class during the calendar year. Receiving Form 1098-T does not necessarily indicate that you are entitled to claim any of the education-related tax credits or deductions. - What should I do with my Form 1098-T?

You should immediately give it to whoever is responsible for preparing your or your parents tax returns. If you prepare your own tax returns, you should keep your Form 1098-T with your other tax documents. Form 1098-T should remain in your files and not be attached to your return when it is filed. - How can I get a copy of my Form 1098-T for a prior year?

Please visit the Heartland ECSI website https://heartland.ecsi.net or call Heartland ECSI Contact Center at (866) 428-1099. - Where can I go for help in understanding my Form 1098-T?

First, please review the FAQs on this page, because they will answer many typical questions. For general information on Form 1098-T and the related tax credits and deductions, you may also want to review the information available from IRS in Publication 970 (Tax Benefits for Education) or elsewhere on the IRS website. - Will my parents receive a copy of Form 1098-T?

We make Form 1098-T available to our students. Each student should provide their 1098-T Form to the individuals claiming them as a dependent. - Should I expect other tax forms from OW?

OW student employees will also receive Form W-2, Wage and Tax Statement, in the mail. - Will OW send a copy of my Form 1098-T to the federal government or the State of New York?

Like all colleges and universities, Old Westbury is required to submit the data from your Form 1098-T to the IRS. The State of New York does not require us to report Form 1098-T data to them. - What if my name, address, or social security number is incorrect on the form?

You will need to contact the Registrar’s Office and provide proof of your address or social security number. - What if I did not get a Form 1098-T?

Students whose account were paid fully with grants, awards or third party payments, and did not make payment to their student account will not have a form generated and/or mailed to them. - Why did I not receive a Form 1098-T for 2024 when I paid for 2023 charges in 2023?

VERY IMPORTANT: If you registered for Winter or Spring 2023 during November or December 2023 and you paid in 2023 (this was noted in Box 7), those charges were reported on your 2023 Form 1098-T. For more information regarding how this should be handled on your tax return, refer to www.irs.gov/forms-pubs/about-publication-970 or contact the IRS Help Line.

Students who graduated in Spring 2024 and were billed for Spring tuition and fees in December 2023, may not receive a 2024 Form 1098-T if they paid in 2023. Those charges were reported on your 2023 Form 1098-T. For regulations regarding reporting these charges, please consult the IRS. - What is SUNY Old Westbury’s Tax Id Number?

SUNY Old Westbury’s Tax ID Number is 16-1514621.

Accessing the 1098-T Form Information On-line

- How do I get my Form 1098-T online?

It's easy. - Log in through the Heartland ECSI website, https://heartland.ecsi.net

SUNY has contracted with Heartland ECSI to create and manage the Form 1098-T process. Heartland ECSI provides students the ability to easily access and view their Form 1098-T online through the use of their tax document search. Students will need their first and last name, social security number, and zip code to access the form. - ECSI FAQ Page: https://heartland.ecsi.net/index.main.html#/access/FAQtaxDocuments

- Are these sites secure?

Yes. Access can only be obtained by logging in through the ECSI website. - Can I opt-out of receiving a paper copy of my Form 1098-T?

- Yes, Heartland ECSI provides a quick, easy and secure process for you to opt-out of receiving paper forms. Give consent to receiving your Form 1098-T electronically.

- Follow the step-by-step instructions on the web form.

- Check the box and click Submit.

- Note: You must opt-out by January 1, 2025.

- What if there is no 1098-T information to view for Tax Year 2024?

A Form 1098-T will be issued if, during the tax year, payments were made and applied to your tuition and fees. If your account was covered fully by financial aid grants and/or awards, you will not have a Form 1098-T generated.